Advertisement

A systematic review of fundamental and technical analysis of stock market predictions

- Published: 20 August 2019

- Volume 53 , pages 3007–3057, ( 2020 )

Cite this article

- Isaac Kofi Nti ORCID: orcid.org/0000-0001-9257-4295 1 , 2 ,

- Adebayo Felix Adekoya ORCID: orcid.org/0000-0002-5029-2393 2 &

- Benjamin Asubam Weyori ORCID: orcid.org/0000-0001-5422-4251 2

19k Accesses

258 Citations

Explore all metrics

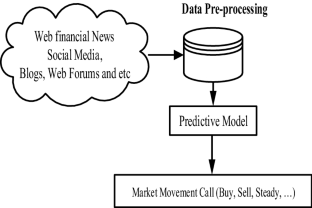

The stock market is a key pivot in every growing and thriving economy, and every investment in the market is aimed at maximising profit and minimising associated risk. As a result, numerous studies have been conducted on the stock-market prediction using technical or fundamental analysis through various soft-computing techniques and algorithms. This study attempted to undertake a systematic and critical review of about one hundred and twenty-two (122) pertinent research works reported in academic journals over 11 years (2007–2018) in the area of stock market prediction using machine learning. The various techniques identified from these reports were clustered into three categories, namely technical, fundamental, and combined analyses. The grouping was done based on the following criteria: the nature of a dataset and the number of data sources used, the data timeframe, the machine learning algorithms used, machine learning task, used accuracy and error metrics and software packages used for modelling. The results revealed that 66% of documents reviewed were based on technical analysis; whiles 23% and 11% were based on fundamental analysis and combined analyses, respectively. Concerning the number of data source, 89.34% of documents reviewed, used single sources; whiles 8.2% and 2.46% used two and three sources respectively. Support vector machine and artificial neural network were found to be the most used machine learning algorithms for stock market prediction.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Stock Market Prediction Using Machine Learning Techniques: A Comparative Study

A survey of recent machine learning techniques for stock prediction methodologies

A Study on Stock Market Forecasting and Machine Learning Models: 1970–2020

Explore related subjects.

- Artificial Intelligence

Abhishek K et al (2012) A stock market prediction model using artificial neural network. In: Third international conference on computing communication & networking technologies (ICCCNT), pp 1–5. https://doi.org/10.1109/icccnt.2012.6396089

Adam AM, Tweneboah G (2008) Macroeconomic factors and stock market movement: evidence from Ghana. University of Leicester, Leicester. https://doi.org/10.2139/ssrn.1289842

Book Google Scholar

Adebayo AD, Adekoya AF, Rahman TM (2017) Predicting stock trends using Tsk-fuzzy rule based system. JENRM 4(7):48–55

Google Scholar

Adebiyi AA et al (2012) Stock price prediction using neural network with hybridized market indicators. J Emerg Trends Comput Inf Sci 3(1):1–9

Adebiyi AA, Adewumi AO, Ayo CK (2014a) Comparison of ARIMA and artificial neural networks models for stock price prediction. J Appl Math 2014:9–11. https://doi.org/10.1155/2014/614342

Article MathSciNet Google Scholar

Adebiyi AA, Adewumi AO, Ayo CK (2014) Stock price prediction using the ARIMA model. In: Proceedings—UKSim-AMSS 16th international conference on computer modelling and simulation, UKSim 2014, pp 106–112. https://doi.org/10.1109/uksim.2014.67

Adusei M (2014) The inflation-stock market returns nexus: evidence from the Ghana stock exchange. J Econ Int Finance 6(2):38–46. https://doi.org/10.5958/2321-5763.2016.00010.X

Article Google Scholar

Agarwal P et al (2017) Stock market price trend forecasting using machine learning. Int J Res Appl Sci Eng Technol: IJRASET 5(IV):1673–1676

Agrawal S, Jindal M, Pillai GN (2010) Momentum analysis based stock market prediction using adaptive neuro-fuzzy inference system (ANFIS). In: International multiconference of engineers and computer scientists (IMECS). Hong Kong

Agrawal JG, Chourasia VS, Mittra AK (2013) State-of-the-art in stock prediction techniques. Int J Adv Res Electr Electron Instrum Eng 2(4):1360–1366

Ahmadi E et al (2018) New efficient hybrid candlestick technical analysis model for stock market timing on the basis of the support vector machine and heuristic algorithms of imperialist competition and genetic. Expert Syst Appl 94(April):21–31. https://doi.org/10.1016/j.eswa.2017.10.023

Akinwale Adio T, Arogundade OT, Adekoya AF (2009) Translated Nigeria stock market prices using artificial neural network for effective prediction. J Theor Appl Inf Technol. pp 36–43. http://jatit.org/volumes/research-papers/Vol9No1/6Vol9No1.pdf

Almeida L, Lorena A, De Oliveira I (2010) Expert systems with applications a method for automatic stock trading combining technical analysis and nearest neighbor classification. Expert Syst Appl 37(10):6885–6890. https://doi.org/10.1016/j.eswa.2010.03.033

Anbalagan T, Maheswari SU (2014) Classification and prediction of stock market index based on fuzzy metagraph. Procedia Comput Sci 47(C):214–221. https://doi.org/10.1016/j.procs.2015.03.200

Ansari T et al (2010) Sequential combination of statistics, econometrics and adaptive neural-fuzzy interface for stock market prediction. Expert Syst Appl 37(7):5116–5125. https://doi.org/10.1016/j.eswa.2009.12.083

Anthony J, Maurice L, Eshwar S (2011) Predictive ability of the interest rate spread using neural networks. Procedia Comput Sci 6:207–212. https://doi.org/10.1016/j.procs.2011.08.039

Argiddi VR, Apte SS (2012) Future trend prediction of Indian IT stock market using association rule mining of transaction data. Int J Comput Appl 39(10):30–34. https://doi.org/10.5120/4858-7132

Asadi S et al (2012) Hybridization of evolutionary Levenberg–Marquardt neural networks and data pre-processing for stock market prediction. Knowl Based Syst 35:245–258. https://doi.org/10.1016/j.knosys.2012.05.003

Atsalakis GS, Dimitrakakis EM, Zopounidis CD (2011) Elliott wave theory and neuro-fuzzy systems, in stock market prediction: the WASP system. Expert Syst Appl 38(8):9196–9206. https://doi.org/10.1016/j.eswa.2011.01.068

Ayub A (2018) Volatility transmission from oil prices to agriculture commodity and stock market in Pakistan. Capital University of Science and Technology, Islamabad

Babu MS, Geethanjali N, Satyanarayana PB (2012) Clustering approach to stock market prediction. Int J Adv Netw Appl 03(04):1281–1291

Baker M, Wurgler J (2007) Investor sentiment in the stock market. http://www.nber.org/papers/w13189

Ballings M et al (2015) Evaluating multiple classifiers for stock price direction prediction. Expert Syst Appl 42(20):7046–7056. https://doi.org/10.1016/j.eswa.2015.05.013

Bhagwant C et al (2014) Stock market prediction using artificial neural networks. Int J Comput Sci Inf Technol 5(1):904–907. https://doi.org/10.4028/www.scientific.net/AEF.6-7.1055

Bisoi R, Dash PK (2014) A hybrid evolutionary dynamic neural network for stock market trend analysis and prediction using unscented Kalman filter. Appl Soft Comput J 19:41–56. https://doi.org/10.1016/j.asoc.2014.01.039

Boachie MK et al (2016) Interest rate, liquidity and stock market performance in Ghana. Int J Account Econ Stud 4(1):46. https://doi.org/10.14419/ijaes.v4i1.5990

Bollen J, Mao H, Zeng X-J (2011) Twitter mood predicts the stock market. J Comput Sci 2(1):1–8. https://doi.org/10.1016/j.jocs.2010.12.007

Bordino I et al (2012) Web search queries can predict stock market volumes. PLoS ONE. https://doi.org/10.1371/journal.pone.0040014

Boyacioglu MA, Avci D (2010) Adaptive network-based fuzzy inference system (ANFIS) for the prediction of stock market return: the case of the Istanbul stock exchange. Expert Syst Appl 37(12):7908–7912. https://doi.org/10.1016/j.eswa.2010.04.045

Chakravarty S, Dash PK (2012) A PSO based integrated functional link net and interval type-2 fuzzy logic system for predicting stock market indices. Appl Soft Comput J 12(2):931–941. https://doi.org/10.1016/j.asoc.2011.09.013

Chan K et al (2017) What do stock price levels tell us about the firms? J Corp Finance 46:34–50. https://doi.org/10.1016/j.jcorpfin.2017.06.013

Chang SV et al (2013) A review of stock market prediction with artificial neural network (ANN). In: 2013 IEEE international conference on control system, computing and engineering, pp 477–482. https://doi.org/10.1109/iccsce.2013.6720012

Checkley MS, Higón DA, Alles H (2017) The hasty wisdom of the mob: how market sentiment predicts stock market behavior. Expert Syst Appl 77:256–263. https://doi.org/10.1016/j.eswa.2017.01.029

Chen C et al (2014) Exploiting social media for stock market prediction with factorization machine. In: 2014 IEEE/WIC/ACM international joint conference on web intelligence and intelligent agent technology—workshops, WI-IAT 2014, pp 49–56. https://doi.org/10.1109/wi-iat.2014.91

Chen Y, Hao Y (2017) A feature weighted support vector machine and K-nearest neighbor algorithm for stock market indices prediction. Expert Syst Appl 80:340–355. https://doi.org/10.1016/j.eswa.2017.02.044

Chen R, Lazer M (2013) Sentiment analysis of Twitter feeds for the prediction of stock market movement. Stanf Educ 25:1–5. https://doi.org/10.1016/j.ufug.2017.05.003

Chong E, Han C, Park FC (2017) Deep learning networks for stock market analysis and prediction: methodology, data representations, and case studies. Expert Syst Appl 83:187–205. https://doi.org/10.1016/j.eswa.2017.04.030

Coyne S, Madiraju P, Coelho J (2017) Forecasting stock prices using social media analysis. In: IEEE 15th international conference on big data intelligence and computing and cyber science and technology congress. IEEE Computer Society, pp 1031–1038. https://doi.org/10.1109/dasc-picom-datacom-cyberscitec.2017.169

Dase RK, Pawar DD (2010) Application of artificial neural network for stock market predictions: a review of literature. Int J Mach Intell 2(2):14–17

Dash R, Dash PK (2016) Efficient stock price prediction using a self evolving recurrent neuro-fuzzy inference system optimized through a modified technique. Expert Syst Appl 52:75–90. https://doi.org/10.1016/j.eswa.2016.01.016

de Araújo RA (2010) A quantum-inspired evolutionary hybrid intelligent approach for stock market prediction. Int J Intell Comput Cybern 3(1):24–54

Article MathSciNet MATH Google Scholar

de Araújo RA, Ferreira TAE (2013) A morphological-rank-linear evolutionary method for stock market prediction. Inf Sci 237:3–17. https://doi.org/10.1016/j.ins.2009.07.007

de Oliveira FA, Nobre CN, Zárate LE (2013) Applying artificial neural networks to prediction of stock price and improvement of the directional prediction index—case study of PETR4, Petrobras, Brazil. Expert Syst Appl 40(18):7596–7606. https://doi.org/10.1016/j.eswa.2013.06.071

Demyanyk Y, Hasan I (2010) Financial crises and bank failures: a review of prediction methods. Omega. https://doi.org/10.1016/j.omega.2009.09.007

Ding X et al (2014) Using structured events to predict stock price movement: an empirical investigation. In: The 2014 conference on empirical methods in natural language processing (EMNLP). Association for Computational Linguistics, Doha, pp 1415–1425. https://doi.org/10.3115/v1/d14-1148

Dondio P (2013) Stock market prediction without sentiment analysis: using a web-traffic based classifier and user-level analysis. In: Proceedings of the annual hawaii international conference on system sciences, pp 3137–3146. https://doi.org/10.1109/hicss.2013.498

Dosdoğru AT et al (2018) Assessment of hybrid artificial neural networks and metaheuristics for stock market forecasting. Ç. Ü. Sosyal Bilimler Enstitüsü Dergisi 24(1):63–78

Dunne M (2015) Stock market prediction. University College Cork, Cork

Dutta A, Bandopadhyay G, Sengupta S (2012) Prediction of stock performance in the indian stock market using logistic regression. Int J Bus Inf 7(1):105–136

Enke D, Mehdiyev N (2013) Stock market prediction using a combination of stepwise regression analysis, differential evolution-based fuzzy clustering, and a fuzzy inference neural network. Intell Autom Soft Comput 19(4):636–648. https://doi.org/10.1080/10798587.2013.839287

Enke D, Grauer M, Mehdiyev N (2011) Stock market prediction with multiple regression, fuzzy type-2 clustering and neural networks. Procedia Comput Sci 6:201–206. https://doi.org/10.1016/j.procs.2011.08.038

Ertuna L (2016) Stock market prediction using neural network time series forecasting (May). https://doi.org/10.13140/rg.2.1.1954.1368

Esfahanipour A, Aghamiri W (2010) Adapted neuro-fuzzy inference system on indirect approach TSK fuzzy rule base for stock market analysis. Expert Syst Appl 37(7):4742–4748. https://doi.org/10.1016/j.eswa.2009.11.020

Fajiang L, Wang J (2012) Fluctuation prediction of stock market index by Legendre neural network with random time strength function. Neurocomputing 83:12–21. https://doi.org/10.1016/j.neucom.2011.09.033

Fama EF (1965) Random walks in stock market prices. Financ Anal J 21:55–59

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–417

Fang Y et al (2014) Improving the genetic-algorithm-optimized wavelet neural network for stock market prediction. In: International joint conference on neural networks. IEEE, Beijing, pp 3038–3042. https://doi.org/10.1109/ijcnn.2014.6889969

Gaius KD (2015) Assessing the performance of active and passive trading on the Ghana stock exchange. University of Ghana, Accra

García F, Guijarro F, Oliver J (2018) Hybrid fuzzy neural network to predict price direction in the German DAX-30 index. Technol Econ Dev Econ 24(6):2161–2178

Geva T, Zahavi J (2014) Empirical evaluation of an automated intraday stock recommendation system incorporating both market data and textual news. Decis Support Syst 57(1):212–223. https://doi.org/10.1016/j.dss.2013.09.013

Ghaznavi A, Aliyari M, Mohammadi MR (2016) Predicting stock price changes of tehran artmis company using radial basis function neural networks. Int Res J Appl Basic Sci 10(8):972–978

Göçken M et al (2016) Integrating metaheuristics and artificial neural networks for improved stock price prediction. Expert Syst Appl 44:320–331. https://doi.org/10.1016/j.eswa.2015.09.029

Goel SK, Poovathingal B, Kumari N (2016) Applications of neural networks to stock market prediction. Int Res J Eng Technol: IRJET 03(05):2192–2197

Gupta A, Sharma SD (2014) Clustering-classification based prediction of stock market future prediction. Int J Comput Sci Inf Technol 5(3):2806–2809

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Expert Syst Appl 38(8):10389–10397. https://doi.org/10.1016/j.eswa.2011.02.068

Gyan MK (2015) Factors influencing the patronage of stocks, Knu. Kwame Nkrumah University of Science & Technology (KNUST), Kumasi

Hadavandi E, Shavandi H, Ghanbari A (2010) Knowledge-based systems integration of genetic fuzzy systems and artificial neural networks for stock price forecasting. Knowl Based Syst 23(8):800–808. https://doi.org/10.1016/j.knosys.2010.05.004

Hagenau M, Liebmann M, Neumann D (2013) Automated news reading: stock price prediction based on financial news using context-capturing features. Decis Support Syst 55(3):685–697. https://doi.org/10.1016/j.dss.2013.02.006

Hassan MR et al (2013) A HMM-based adaptive fuzzy inference system for stock market forecasting. Neurocomputing 104:10–25. https://doi.org/10.1016/j.neucom.2012.09.017

Hegazy O, Soliman OS, Salam MA (2013) A machine learning model for stock market prediction. Int J Comput Sci Telecommun 4(12):17–23

Henriksson A et al (2016) Ensembles of randomized trees using diverse distributed representation of clinical events. BMC Med Inf Decis Mak 16(2):69

Ibrahim SO (2017) Forecasting the volatilities of the Nigeria stock market prices. CBN J Appl Stat 8(2):23–45

MathSciNet Google Scholar

Javed K, Gouriveau R, Zerhouni N (2014) SW-ELM: a summation wavelet extreme learning machine algorithm with a priori parameter initialization. Neurocomputing 123:299–307. https://doi.org/10.1016/j.neucom.2013.07.021

Jianfeng S et al (2014) Exploiting social relations and sentiment for stock prediction. In: Conference on empirical methods in natural language processing (EMNLP). Association for Computational Linguistics, Doha, pp 1139–1145. https://doi.org/10.1080/00378941.1956.10837773

Ju-Jie W et al (2012) Stock index forecasting based on a hybrid model. Omega 40(6):758–766. https://doi.org/10.1016/j.omega.2011.07.008

Kannan KS et al (2010) Financial stock market forecast using data mining techniques. In: International multiconference of engineers and computer scientists (IMECS)

Kara Y, Acar Boyacioglu M, Baykan ÖK (2011) Predicting direction of stock price index movement using artificial neural networks and support vector machines: the sample of the Istanbul stock exchange. Expert Syst Appl 38(5):5311–5319. https://doi.org/10.1016/j.eswa.2010.10.027

Kazem A et al (2013) Support vector regression with chaos-based firefly algorithm for stock market price forecasting. Appl Soft Comput J 13(2):947–958. https://doi.org/10.1016/j.asoc.2012.09.024

Kearney C, Liu S (2014) Textual sentiment in finance: a survey of methods and models. Int Rev Financ Anal 33(Cc):171–185. https://doi.org/10.1016/j.irfa.2014.02.006

Khan HZ, Alin ST, Hussain A (2011) Price prediction of share market using artificial neural network “ANN”. Int J Comput Appl 22(2):42–47. https://doi.org/10.5120/2552-3497

Kraus M, Feuerriegel S (2017) Decision support from financial disclosures with deep neural networks and transfer learning. Decis Support Syst 104:38–48. https://doi.org/10.1016/j.dss.2017.10.001

Krollner B, Vanstone B, Finnie G (2010a) Financial time series forecasting with machine learning techniques: a survey. In: European symposium on artificial neural networks: computational and machine learning. Bond University, Bruges, pp 25–30

Krollner B, Vanstone B, Finnie G (2010b) Financial time series forecasting with machine learning techniques: a survey. http://epublications.bond.edu.au/infotech_pubs/110

Kumar DA, Murugan S (2013) Performance analysis of Indian stock market index using neural network time series model. In: Proceedings of the 2013 international conference on pattern recognition, informatics and mobile engineering, PRIME 2013, pp 72–78. https://doi.org/10.1109/icprime.2013.6496450

Kumar M, Thenmozhi M (2006) Forecasting stock index movement: a comparison of support vector machines and random forest. In Indian Institute of capital markets 9th capital markets conference paper.

Kumar D, Meghwani SS, Thakur M (2016) Proximal support vector machine based hybrid prediction models for trend forecasting in financial markets. J Comput Sci 17:1–13. https://doi.org/10.1016/j.jocs.2016.07.006

Kuwornu JKM, Victor O-N (2011) Macroeconomic variables and stock market returns: full information maximum likelihood estimation. Res J Finance Account 2(4):49–64

Kwofie C, Ansah RK (2018) A study of the effect of inflation and exchange rate on stock market returns in Ghana. Int J Math Math Sci. https://doi.org/10.1155/2018/7016792

Laboissiere LA, Fernandes RAS, Lage GG (2015) Maximum and minimum stock price forecasting of Brazilian power distribution companies based on artificial neural networks. Appl Soft Comput J 35:66–74. https://doi.org/10.1016/j.asoc.2015.06.005

Lahmiri S (2011) A Comparison of PNN and SVM for stock market trend prediction using economic and technical information. Int J Comput Appl 29(3):975–8887

Li Q et al (2015) Tensor-based learning for predicting stock movements. In: Twenty-ninth AAAI conference on artificial intelligence-2015, pp 1784–1790. https://doi.org/10.1073/pnas.0601853103

Li Q, Wang T, Gong Q et al (2014a) Media-aware quantitative trading based on public Web information. Decis Support Syst 61(1):93–105. https://doi.org/10.1016/j.dss.2014.01.013

Li Q, Wang T, Li P et al (2014b) The effect of news and public mood on stock movements. Inf Sci 278:826–840. https://doi.org/10.1016/j.ins.2014.03.096

Li X, Huang X et al (2014c) Enhancing quantitative intra-day stock return prediction by integrating both market news and stock prices information. Neurocomputing 142:228–238. https://doi.org/10.1016/j.neucom.2014.04.043

Li X, Xie H et al (2014d) News impact on stock price return via sentiment analysis. Knowl-Based Syst 69(1):14–23. https://doi.org/10.1016/j.knosys.2014.04.022

Lin Z (2018) Modelling and forecasting the stock market volatility of SSE composite index using GARCH models. Future Gener Comput Syst 79:960–972. https://doi.org/10.1016/j.future.2017.08.033

Lin Y, Guo H, Hu J (2013) An SVM-based approach for stock market trend prediction. In: Proceedings of the international joint conference on neural networks. https://doi.org/10.1109/ijcnn.2013.6706743

Liu L et al (2015) A social-media-based approach to predicting stock comovement. Expert Syst Appl 42(8):3893–3901. https://doi.org/10.1016/j.eswa.2014.12.049

Luo F, Wu J, Yan K (2010) A novel nonlinear combination model based on support vector machine for stock market prediction. In: Jinan C (ed) World congress on intelligent control and automation. IEEE, Piscataway, pp 5048–5053

Maknickiene N, Lapinskaite I, Maknickas A (2018) Application of ensemble of recurrent neural networks for forecasting of stock market sentiments. Equilib Q J Econ Econ Policy 13(1):7–27. https://doi.org/10.24136/eq.2018.001

Makrehchi M, Shah S, Liao W (2013) Stock prediction using event-based sentiment analysis. In: Proceedings—2013 IEEE/WIC/ACM international conference on web intelligence, WI 2013, 1, pp 337–342. https://doi.org/10.1109/wi-iat.2013.48

Malkiel BG (1999) A random walk down Wall Street: including a life-cycle guide to personal investing. WW Norton & Company

Metghalchi M, Kagochi J, Hayes LA (2014) Contrarian technical trading rules: evidence from Nairobi stock index. J Appl Bus Res 30(3):833–846

Ming F et al (2014) Stock market prediction from WSJ: text mining via sparse matrix factorization. In: EEE international conference on data mining, ICDM, pp 430–439. https://doi.org/10.1109/icdm.2014.116

Minxia L, Zhang K (2014) A hybrid approach combining extreme learning machine and sparse representation for image classification. Eng Appl Artif Intell 27:228–235. https://doi.org/10.1016/j.engappai.2013.05.012

Mittal A, Goel A (2012) Stock prediction using twitter sentiment analysis. Standford University, CS229, (June). https://doi.org/10.1109/wi-iat.2013.48

Mohapatra P, Raj A (2012) Indian stock market prediction using differential evolutionary neural network model. Int J Electron Commun Comput Technol: IJECCT 2(4):159–166

Murekachiro D (2016) A review of artificial neural networks application to stock market predictions. Netw Complex Syst 6(4):2010–2013

Naeini MP, Taremian H, Hashemi HB (2010) Stock market value prediction using neural networks. IEEE, Piscataway, pp 132–136

Nair BB et al (2010) Stock market prediction using a hybrid neuro-fuzzy system. In: International conference on advances in recent technologies in communication and computing, India, pp 243–247. https://doi.org/10.1109/artcom.2010.76

Nair BB, Mohandas VP, Sakthivel NR (2010) A decision tree-rough set hybrid system for stock market trend prediction. Int J Comput Appl 6(9):1–6

Nassirtoussi AK et al (2014) Text mining for market prediction: a systematic review. Expert Syst Appl 41(16):7653–7670. https://doi.org/10.1016/j.eswa.2014.06.009

Nayak RK, Mishra D, Rath AK (2015) A Naïve SVM-KNN based stock market trend reversal analysis for Indian benchmark indices. Appl Soft Comput J 35:670–680. https://doi.org/10.1016/j.asoc.2015.06.040

Nazário RTF et al (2017) A literature review of technical analysis on stock markets. Q Rev Econ Finance 66:115–126. https://doi.org/10.1016/j.qref.2017.01.014

Neelima B, Jha CK, Saneep BK (2012) Application of neural network in analysis of stock market prediction. Int J Comput Sci Technol: IJCSET 3(4):61–68

Nhu HN, Nitsuwat S, Sodanil M (2013) Prediction of stock price using an adaptive neuro-fuzzy inference system trained by firefly algorithm. In: 2013 international computer science and engineering conference, ICSEC 2013, pp 302–307. https://doi.org/10.1109/icsec.2013.6694798

Nikfarjam A, Emadzadeh E, Muthaiyah S (2010) Text mining approaches for stock market prediction. IEEE, vol 4, pp 256–260

Nisar TM, Yeung M (2018) Twitter as a tool for forecasting stock market movements: a short-window event study. J Finance Data Sci 4(February):1–19. https://doi.org/10.1016/j.jfds.2017.11.002

Olaniyi S, Adewole K, Jimoh R (2011) Stock trend prediction using regression analysis—a data mining approach. ARPN J Syst Softw 1(4):154–157

Paik P, Kumari B (2017) Stock market prediction using ANN, SVM, ELM: a review. Ijettcs 6(3):88–94. https://doi.org/10.1038/33071

Patel J et al (2015a) Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst Appl 42(1):259–268. https://doi.org/10.1016/j.eswa.2014.07.040

Patel J et al (2015b) Predicting stock market index using fusion of machine learning techniques. Expert Syst Appl 42(4):2162–2172. https://doi.org/10.1016/j.eswa.2014.10.031

Pervaiz J, Masih J, Jian-Zhou T (2018) Impact of macroeconomic variables on Karachi stock market returns. Int J Econ Finance 10(2):28. https://doi.org/10.5539/ijef.v10n2p28

Perwej Y, Perwej A (2012) Prediction of the Bombay stock exchange (BSE) market returns using artificial neural network and genetic algorithm. J Intell Learn Syst Appl 04(02):108–119. https://doi.org/10.4236/jilsa.2012.42010

Pimprikar R, Ramachadran S, Senthilkumar K (2017) Use of machine learning algorithms and Twitter sentiment analysis for stock market prediction. Int J Pure Appl Math 115(6):521–526

Porshnev A, Redkin I, Shevchenko A (2013) Improving prediction of stock market indices by analyzing the psychological states of Twitter users. Financ Econ. https://doi.org/10.2139/ssrn.2368151

Prem Sankar C, Vidyaraj R, Satheesh Kumar K (2015) Trust based stock recommendation system—a social network analysis approach. In: Procedia computer science: international conference on information and communication technologies (ICICT 2014). Elsevier Masson SAS, pp 299–305. https://doi.org/10.1016/j.procs.2015.02.024

Pulido M, Melin P, Castillo O (2014) Particle swarm optimization of ensemble neural networks with fuzzy aggregation for time series prediction of the Mexican stock exchange. Inf Sci 342(May):317–329. https://doi.org/10.1007/978-3-319-32229-2_23

Rajashree D, Dash PK, Bisoi R (2014) A self adaptive differential harmony search based optimized extreme learning machine for financial time series prediction. Swarm Evol Comput 19:25–42. https://doi.org/10.1016/j.swevo.2014.07.003

Rather AM, Agarwal A, Sastry VN (2014) Recurrent neural network and a hybrid model for prediction of stock returns. Expert Syst Appl 42(8):3234–3241. https://doi.org/10.1016/j.eswa.2016.05.033

Renu IR, Christie R (2018) Fundamental analysis versus technical analysis—a comparative review. Int J Recent Sci Res 9(1):23009–23013. https://doi.org/10.24327/IJRSR

Sasan B, Azadeh A, Ortobelli S (2017) Fusion of multiple diverse predictors in stock market. Inf Fusion 36:90–102. https://doi.org/10.1016/j.inffus.2016.11.006

Shen S, Jiang H, Zhang T (2012) Stock market forecasting using machine learning algorithms. Department of Electrical Engineering, Stanford University, Stanford, CA, pp 1–5

Sheta A, Farisy H, Alkasassbehz M (2013) A genetic programming model for S&P 500 stock market prediction. Int J Control Autom 6(6):303–314. https://doi.org/10.14257/ijca.2013.6.6.29

Shobana T, Umamakeswari A (2016) A review on prediction of stock market using various methods in the field of data mining. Indian J Sci Technol 9(48):9–14. https://doi.org/10.17485/ijst/2016/v9i48/107985

Shom P Das, Padhy S (2012) Support vector machines for prediction of futures prices in Indian stock market. Int J Comput Appl 41(3):22–26. https://doi.org/10.5120/5522-7555

Si J et al (2013) Exploiting topic based twitter sentiment for stock prediction. In: The 51st annual meeting of the association for computational linguistics, vol 2(2011), pp 24–29. http://www.scopus.com/inward/record.url?eid=2-s2.0-84907356594&partnerID=tZOtx3y1

Solanki H (2013) Comparative study of data mining tools and analysis with unified data mining theory. Int J Comput Appl 75(16):23–28

Soni S (2011) Applications of ANNs in stock market prediction: a survey. In: International conference on computer information systems and industrial management applications (CISIM), vol 2, no. 3, pp 132–136. https://doi.org/10.1177/1040638713493779

Sorto M, Aasheim C, Wimmer H (2017) Feeling the stock market: a study in the prediction of financial markets based on news sentiment. In: Hatzivassiloglou V, Klavans J, Eskin E (eds) Southern association for information systems conference. St. Simons Island, GA, USA, p. 19. http://aisel.aisnet.org/sais2017%0Ahttp://aisel.aisnet.org/sais2017/30%0Ahttp://aisel.aisnet.org/sais2017%0Ahttp://aisel.aisnet.org/sais2017/30

Stanković J, Marković I, Stojanović M (2015) Investment strategy optimization using technical analysis and predictive modeling in emerging markets. Procedia Econ Finance 19(15):51–62. https://doi.org/10.1016/S2212-5671(15)00007-6

Su CH, Cheng CH (2016) A hybrid fuzzy time series model based on ANFIS and integrated nonlinear feature selection method for forecasting stock. Neurocomputing 205:264–273. https://doi.org/10.1016/j.neucom.2016.03.068

Suhaibu I, Harvey SK, Amidu M (2017) The impact of monetary policy on stock market performance: evidence from twelve (12) African countries. Res Int Bus Finance 42(12):1372–1382. https://doi.org/10.1016/j.ribaf.2017.07.075

Sun A, Lachanski M, Fabozzi FJ (2016) Trade the tweet: social media text mining and sparse matrix factorization for stock market prediction. Int Rev Financ Anal 48:272–281. https://doi.org/10.1016/j.irfa.2016.10.009

Sureshkumar KK, Elango NM (2011) An efficient approach to forecast Indian stock market price and their performance analysis. Int J Comput Appl 34(5):44–49. https://doi.org/10.1196/annals.1364.016

Suthar BA, Patel RH, Parikh MS (2012) A comparative study on financial stock market prediction models. Int J Eng Sci: IJES 1(2):188–191. https://doi.org/10.1007/BF00629127

Talib R et al (2016) Text mining-techniques applications and issues. Int J Adv Comput Sci Appl 7(11):414–418

Thanh D Van, Minh Hai N, Hieu DD (2018) Building unconditional forecast model of stock market indexes using combined leading indicators and principal components: application to Vietnamese stock market. Indian J Sci Technol 11(2):1–13. https://doi.org/10.17485/ijst/2018/v11i2/104908

Ticknor JL (2013) A Bayesian regularized artificial neural network for stock market forecasting. Expert Syst Appl 40(14):5501–5506. https://doi.org/10.1016/j.eswa.2013.04.013

Tsai C-F, Hsiao Y-C (2010) Combining multiple feature selection methods for stock prediction: union, intersection, and multi-intersection approaches. Decis Support Syst 50(1):258–269. https://doi.org/10.1016/j.dss.2010.08.028

Tsai MF, Wang C-J (2017) On the risk prediction and analysis of soft information in finance reports. Eur J Oper Res 257(1):243–250. https://doi.org/10.1016/j.ejor.2016.06.069

Tsaurai K (2018) What are the determinants of stock market development in emerging markets? Acad Account Financ Stud J 22(2):1–11

Tziralis G, Tatsiopoulos I (2007) Prediction markets: an extended literature review. J Predict Mark 1:75–91

Umoru D, Nwokoye GA (2018) FAVAR analysis of foreign investment with capital market predictors: evidence on Nigerian and selected African stock exchanges. Acad J Econ Stud 4(1):12–20

Uysal AK, Gunal S (2014) The impact of preprocessing on text classification. Inf Process Manage 50:104–112

Vaisla SK, Bhatt KA (2010) An analysis of the performance of artificial neural network technique for stock market forecasting. Int J Comput Sci Eng 02(06):2104–2109

Vu T-T et al (2012) An experiment in integrating sentiment features for tech stock prediction in Twitter. In: Workshop on information extraction and entity analytics on social media data, pp 23–38. http://www.aclweb.org/anthology/W12-5503

Wang Y (2013) Stock price direction prediction by directly using prices data: an empirical study on the KOSPI and HSI, pp 1–13. https://doi.org/10.1504/ijbidm.2014.065091

Wang L, Qiang W (2011) Stock market prediction using artificial neural networks based on HLP. In: Proceedings—2011 3rd international conference on intelligent human-machine systems and cybernetics, IHMSC 2011, vol 1, pp 116–119. https://doi.org/10.1109/ihmsc.2011.34

Wanjawa BW (2016) Predicting future Shanghai stock market price using ANN in the period 21 Sept 2016 to 11 Oct 2016

Wanjawa BW, Muchemi L (2014) ANN model to predict stock prices at stock exchange markets. Nairobi

Wei LY (2016) A hybrid ANFIS model based on empirical mode decomposition for stock time series forecasting. Appl Soft Comput J 42:368–376. https://doi.org/10.1016/j.asoc.2016.01.027

Wei L-Y, Chen T-L, Ho T-H (2011) A hybrid model based on adaptive-network-based fuzzy inference system to forecast Taiwan stock market. Expert Syst Appl 38(11):13625–13631. https://doi.org/10.1016/j.eswa.2011.04.127

Wensheng D, Wu JY, Lu CJ (2012) Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes. Expert Syst Appl 39(4):4444–4452. https://doi.org/10.1016/j.eswa.2011.09.145

Xi L et al (2014) A new constructive neural network method for noise processing and its application on stock market prediction. Appl Soft Comput J 15:57–66. https://doi.org/10.4171/RLM/692

Yeh C-Y, Huang C-W, Lee S-J (2011) A multiple-kernel support vector regression approach for stock market price forecasting. Expert Syst Appl 38(3):2177–2186. https://doi.org/10.1016/j.eswa.2010.08.004

Yetis Y, Kaplan H, Jamshidi M (2014) Stock market prediction using artificial neural network. In: World Automation Congress. ISI Press, pp 1–5. https://doi.org/10.5120/17399-7959

Yifan L et al (2017) Stock volatility prediction using recurrent neural networks with sentiment analysis. https://doi.org/10.1007/978-3-319-60042-0_22

Yoosin K, Seung RJ, Ghani I (2014) Text opinion mining to analyze news for stock market prediction. Int J Adv Soft Comput Appl 6(1–13):44. https://doi.org/10.1016/S0399-077X(16)30365-1

Yu H, Liu H (2012) Improved stock market prediction by combining support vector machine and empirical mode decomposition. In: 2012 5th international symposium on computational intelligence and design, ISCID 2012, pp 531–534. https://doi.org/10.1109/iscid.2012.138

Zhang X, Fuehres H, Gloor PA (2011) Predicting stock market indicators through Twitter “I hope it is not as bad as I fear”. Procedia Soc Behav Sci 26(2007):55–62. https://doi.org/10.1016/j.sbspro.2011.10.562

Zhang X et al (2014) A causal feature selection algorithm for stock prediction modeling. Neurocomputing 142:48–59. https://doi.org/10.1016/j.neucom.2014.01.057

Zhang X et al (2017) Improving stock market prediction via heterogeneous information fusion. Knowl Based Syst 143:236–247. https://doi.org/10.1016/j.knosys.2017.12.025

Zhou Z, Xu K, Zhao J (2017) Tales of emotion and stock in China: volatility, causality and prediction. https://doi.org/10.1007/s11280-017-0495-4

Zhou X et al (2018) Stock market prediction on high frequency data using generative adversarial nets. Math Probl Eng 2018:1–12. https://doi.org/10.1155/2018/4907423

Download references

The declare that they have not received any funding or Grant for this work.

Author information

Authors and affiliations.

Department of Computer Science, Sunyani Technical University, Sunyani, Ghana

Isaac Kofi Nti

Department of Computer Science and Informatics, University of Energy and Natural Resources, Sunyani, Ghana

Isaac Kofi Nti, Adebayo Felix Adekoya & Benjamin Asubam Weyori

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Isaac Kofi Nti .

Ethics declarations

Conflict of interest.

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 2 , 3 , 4 , 5 , 6 and 7 .

Rights and permissions

Reprints and permissions

About this article

Nti, I.K., Adekoya, A.F. & Weyori, B.A. A systematic review of fundamental and technical analysis of stock market predictions. Artif Intell Rev 53 , 3007–3057 (2020). https://doi.org/10.1007/s10462-019-09754-z

Download citation

Published : 20 August 2019

Issue Date : April 2020

DOI : https://doi.org/10.1007/s10462-019-09754-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Machine-learning

- Stock-prediction

- Artificial intelligence

- Technical-analysis

- Fundamental-analysis

- Find a journal

- Publish with us

- Track your research

IMAGES

COMMENTS

Introduction Based on a review of several Fundamental Analysis's literature (e.g., Fontanilla & Gentile, 2001 ˬThomsett, 2006 ˬ Faerber, 2008), we came to a comprehensive concept for Fundamental Analysis, it is "Knowledge of the rules and fixed steps access to its objectives of determining the intrinsic value of shares in stock markets ...

Fundamental Analysis is a significant tool to gaze the company's fundamental strength, and plays avital role in investment decisions making by the investors. ... REVIEW OF LITERATURE DynaSeng, and Jason R.Hancock,Fundamental analysis and the prediction of earnings, (2012) this paper takes ...

s research paper presents a review of the literature on exchange rate forecasting methods for comparing the economic and the psychological approach of the exchange rate, and proposes a theoretical basis for the method of technical analysis. Index Terms — Fu. ndamental analysis, Technical analysis, exchange rate. ——————————

The stock market is a key pivot in every growing and thriving economy, and every investment in the market is aimed at maximising profit and minimising associated risk. As a result, numerous studies have been conducted on the stock-market prediction using technical or fundamental analysis through various soft-computing techniques and algorithms. This study attempted to undertake a systematic ...

The purpose of this paper is an attempt to reach a better stock valuation model of the Fundamental Analysis Approach, by reviewing the theoretical foundations and literature reviews.

Brief Literature Review Financial markets have gone through several periods of crisis in recent years, resulting ... Fundamental analysis is a method of measuring a company's stock intrinsic value by examining economic, industrial and financial factors (Kovács & Terták, 2019). In terms of the development

Fundamental analysis and technical analysis can co-exist in peace and complement each other. Since all the investors in the stock market want to make the maximum profits possible, they just cannot afford to ignore either fundamental or technical analysis. 1.2. Literature. Review The origin of Fundamental analysis for the share price

An analysis of the present and new (fundamental analysis, tec hnical analysis, and machine learning) techniques in stock -market prediction were carried to verify if there is sufficient evi ...

Fundamental analysis focuses on fundamental information. In case a company's stock price or return is forecasted, fundamental information is, ... This literature review encompasses 138 scientific articles containing 2173 unique variables. Each variable was assigned to one of four types: "Technical Indicator", "Macro-Economy ...

The literature on financial statement analysis attempts to improve fundamental analysis and to identify market inefficiencies with respect to financial statement information. In this paper, I review the extant research on financial statement analysis.