The Great Recession and Its Aftermath

The period known as the Great Moderation came to an end when the decade-long expansion in US housing market activity peaked in 2006 and residential construction began declining. In 2007, losses on mortgage-related financial assets began to cause strains in global financial markets, and in December 2007 the US economy entered a recession. That year several large financial firms experienced financial distress , and many financial markets experienced significant turbulence. In response, the Federal Reserve provided liquidity and support through a range of programs motivated by a desire to improve the functioning of financial markets and institutions, and thereby limit the harm to the US economy. 1 Nonetheless, in the fall of 2008, the economic contraction worsened, ultimately becoming deep enough and protracted enough to acquire the label “the Great Recession ." While the US economy bottomed out in the middle of 2009, the recovery in the years immediately following was by some measures unusually slow. The Federal Reserve has provided unprecedented monetary accommodation in response to the severity of the contraction and the gradual pace of the ensuing recovery. In addition, the financial crisis led to a range of major reforms in banking and financial regulation, congressional legislation that significantly affected the Federal Reserve.

Rise and Fall of the Housing Market

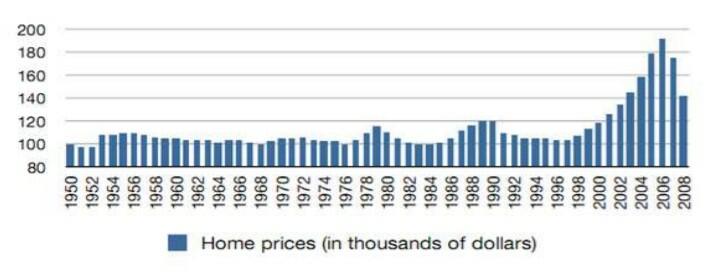

The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing credit. This expansion began in the 1990s and continued unabated through the 2001 recession, accelerating in the mid-2000s. Average home prices in the United States more than doubled between 1998 and 2006, the sharpest increase recorded in US history, and even larger gains were recorded in some regions. Home ownership in this period rose from 64 percent in 1994 to 69 percent in 2005, and residential investment grew from about 4.5 percent of US gross domestic product to about 6.5 percent over the same period. Roughly 40 percent of net private sector job creation between 2001 and 2005 was accounted for by employment in housing-related sectors.

The expansion in the housing sector was accompanied by an expansion in home mortgage borrowing by US households. Mortgage debt of US households rose from 61 percent of GDP in 1998 to 97 percent in 2006. A number of factors appear to have contributed to the growth in home mortgage debt. In the period after the 2001 recession, the Federal Open Market Committee (FOMC) maintained a low federal funds rate, and some observers have suggested that by keeping interest rates low for a “prolonged period” and by only increasing them at a “measured pace” after 2004, the Federal Reserve contributed to the expansion in housing market activity (Taylor 2007). However, other analysts have suggested that such factors can only account for a small portion of the increase in housing activity (Bernanke 2010). Moreover, the historically low level of interest rates may have been due, in part, to large accumulations of savings in some emerging market economies, which acted to depress interest rates globally (Bernanke 2005). Others point to the growth of the market for mortgage-backed securities as contributing to the increase in borrowing. Historically, it was difficult for borrowers to obtain mortgages if they were perceived as a poor credit risk, perhaps because of a below-average credit history or the inability to provide a large down payment. But during the early and mid-2000s, high-risk, or “subprime,” mortgages were offered by lenders who repackaged these loans into securities. The result was a large expansion in access to housing credit , helping to fuel the subsequent increase in demand that bid up home prices nationwide.

Effects on the Financial Sector

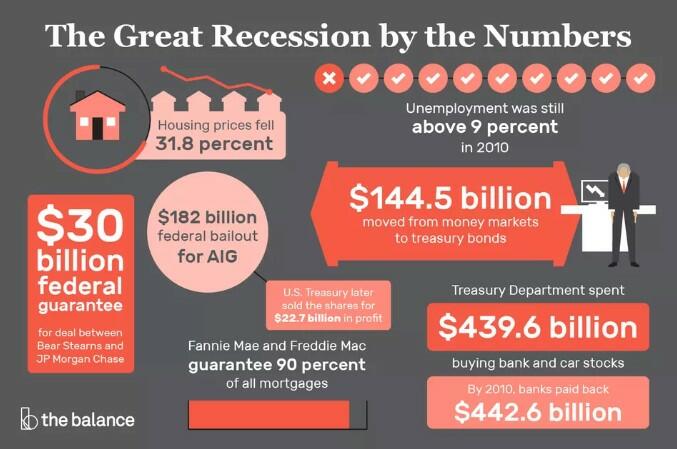

After home prices peaked in the beginning of 2007, according to the Federal Housing Finance Agency House Price Index, the extent to which prices might eventually fall became a significant question for the pricing of mortgage-related securities because large declines in home prices were viewed as likely to lead to an increase in mortgage defaults and higher losses to holders of such securities. Large, nationwide declines in home prices had been relatively rare in the US historical data, but the run-up in home prices also had been unprecedented in its scale and scope. Ultimately, home prices fell by over a fifth on average across the nation from the first quarter of 2007 to the second quarter of 2011. This decline in home prices helped to spark the financial crisis of 2007-08, as financial market participants faced considerable uncertainty about the incidence of losses on mortgage-related assets. In August 2007, pressures emerged in certain financial markets, particularly the market for asset-backed commercial paper, as money market investors became wary of exposures to subprime mortgages (Covitz, Liang, and Suarez 2009). In the spring of 2008, the investment bank Bear Stearns was acquired by JPMorgan Chase with the assistance of the Federal Reserve. In September, Lehman Brothers filed for bankruptcy, and the next day the Federal Reserve provided support to AIG , a large insurance and financial services company. Citigroup and Bank of America sought support from the Federal Reserve, the Treasury, and the Federal Deposit Insurance Corporation.

The Fed’s support to specific financial institutions was not the only expansion of central bank credit in response to the crisis. The Fed also introduced a number of new lending programs that provided liquidity to support a range of financial institutions and markets. These included a credit facility for “primary dealers,” the broker-dealers that serve as counterparties for the Fed’s open market operations, as well as lending programs designed to provide liquidity to money market mutual funds and the commercial paper market. Also introduced, in cooperation with the US Department of the Treasury, was the Term Asset-Backed Securities Loan Facility (TALF), which was designed to ease credit conditions for households and businesses by extending credit to US holders of high-quality asset-backed securities.

Initially, the expansion of Federal Reserve credit was financed by reducing the Federal Reserve’s holdings of Treasury securities, in order to avoid an increase in bank reserves that would drive the federal funds rate below its target as banks sought to lend out their excess reserves. But in October 2008, the Federal Reserve gained the authority to pay banks interest on their excess reserves. This gave banks an incentive to hold onto their reserves rather than lending them out, thus mitigating the need for the Federal Reserve to offset its expanded lending with reductions in other assets. 2

Effects on the Broader Economy

The housing sector led not only the financial crisis, but also the downturn in broader economic activity. Residential investment peaked in 2006, as did employment in residential construction. The overall economy peaked in December 2007, the month the National Bureau of Economic Research recognizes as the beginning of the recession. The decline in overall economic activity was modest at first, but it steepened sharply in the fall of 2008 as stresses in financial markets reached their climax. From peak to trough, US gross domestic product fell by 4.3 percent, making this the deepest recession since World War II. It was also the longest, lasting eighteen months. The unemployment rate more than doubled, from less than 5 percent to 10 percent.

In response to weakening economic conditions, the FOMC lowered its target for the federal funds rate from 4.5 percent at the end of 2007 to 2 percent at the beginning of September 2008. As the financial crisis and the economic contraction intensified in the fall of 2008, the FOMC accelerated its interest rate cuts, taking the rate to its effective floor – a target range of 0 to 25 basis points – by the end of the year. In November 2008, the Federal Reserve also initiated the first in a series of large-scale asset purchase (LSAP) programs, buying mortgage-backed securities and longer-term Treasury securities. These purchases were intended to put downward pressure on long-term interest rates and improve financial conditions more broadly, thereby supporting economic activity (Bernanke 2012).

The recession ended in June 2009, but economic weakness persisted. Economic growth was only moderate – averaging about 2 percent in the first four years of the recovery – and the unemployment rate, particularly the rate of long-term unemployment, remained at historically elevated levels. In the face of this prolonged weakness, the Federal Reserve maintained an exceptionally low level for the federal funds rate target and sought new ways to provide additional monetary accommodation. These included additional LSAP programs, known more popularly as quantitative easing, or QE. The FOMC also began communicating its intentions for future policy settings more explicitly in its public statements, particularly the circumstances under which exceptionally low interest rates were likely to be appropriate. For example, in December 2012, the committee stated that it anticipates that exceptionally low interest rates would likely remain appropriate at least as long as the unemployment rate was above a threshold value of 6.5 percent and inflation was expected to be no more than a half percentage point above the committee’s 2 percent longer-run goal. This strategy, known as “forward guidance,” was intended to convince the public that rates would stay low at least until certain economic conditions were met, thereby putting downward pressure on longer-term interest rates.

Effects on Financial Regulation

When the financial market turmoil had subsided, attention naturally turned to reforms to the financial sector and its supervision and regulation, motivated by a desire to avoid similar events in the future. A number of measures have been proposed or put in place to reduce the risk of financial distress. For traditional banks, there are significant increases in the amount of required capital overall, with larger increases for so-called “systemically important” institutions (Bank for International Settlements 2011a; 2011b). Liquidity standards will for the first time formally limit the amount of banks’ maturity transformation (Bank for International Settlements 2013). Regular stress testing will help both banks and regulators understand risks and will force banks to use earnings to build capital instead of paying dividends as conditions deteriorate (Board of Governors 2011).

The Dodd-Frank Act of 2010 also created new provisions for the treatment of large financial institutions. For example, the Financial Stability Oversight Council has the authority to designate nontraditional credit intermediaries “Systemically Important Financial Institutions” (SIFIs), which subjects them to the oversight of the Federal Reserve. The act also created the Orderly Liquidation Authority (OLA), which allows the Federal Deposit Insurance Corporation to wind down certain institutions when the firm’s failure is expected to pose a great risk to the financial system. Another provision of the act requires large financial institutions to create “living wills,” which are detailed plans laying out how the institution could be resolved under US bankruptcy code without jeopardizing the rest of the financial system or requiring government support.

Like the Great Depression of the 1930s and the Great Inflation of the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. While it may be many years before the causes and consequences of these events are fully understood, the effort to untangle them is an important opportunity for the Federal Reserve and other agencies to learn lessons that can inform future policy.

- 1 Many of these actions were taken under Section 13(3) of the Federal Reserve Act, which at that time authorized lending to individuals, partnerships, and corporations in “unusual and exigent” circumstances and subject to other restrictions. After the amendments to Section 13(3) made by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Federal Reserve lending under Section 13(3) is permitted only to participants in a program or facility with “broad based eligibility,” with prior approval of the secretary of the treasury, and when several other conditions are met.

- 2 For more on interest on reserves, see Ennis and Wolman (2010).

Bibliography

Bank for International Settlements. “ Basel III: A global regulatory framework for more resilient banks and banking system .” Revised June 2011a.

Bank for International Settlements. “ Global systemically important banks: Assessment methodology and the additional loss absorbency requirement .” July 2011b.

Bernanke, Ben, “The Global Saving Glut and the U.S. Current Account Deficit,” Speech given at the Sandridge Lecture, Virginia Association of Economists, Richmond, Va., March 10, 2005.

Bernanke, Ben,“Monetary Policy and the Housing Bubble,” Speech given at the Annual Meeting of the American Economic Association, Atlanta, Ga., January 3, 2010.

Bernanke, Ben, “Monetary Policy Since the Onset of the Crisis,” Speech given at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyo., August 31, 2012.

Covitz, Daniel, Nellie Liang, and Gustavo Suarez. “The Evolution of a Financial Crisis: Collapse of the Asset-Backed Commercial Paper Market.” Journal of Finance 68, no. 3 (2013): 815-48.

Ennis, Huberto, and Alexander Wolman. “Excess Reserves and the New Challenges for Monetary Policy.” Federal Reserve Bank of Richmond Economic Brief no. 10-03 (March 2010).

Federal Reserve System, Capital Plan , 76 Fed Reg. 74631 (December 1, 2011) (codified at 12 CFR 225.8).

Taylor, John,“Housing and Monetary Policy,” NBER Working Paper 13682, National Bureau of Economic Research, Cambridge, MA, December 2007.

Written as of November 22, 2013. See disclaimer .

Essays in this Time Period

- Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

- Federal Reserve Credit Programs During the Meltdown

- The Great Recession

- Subprime Mortgage Crisis

- Support for Specific Institutions

Related People

Ben S. Bernanke Chairman

Board of Governors

2006 – 2014

Timothy F. Geithner President

New York Fed

2003 – 2008

Related Links

- FRASER: Text of Dodd Frank Act

Federal Reserve History

- Call to +1 844 889-9952

The Great Recession of 2008 in the United States

Introduction.

The last months of 2007 saw unprecedented economic growth with the Dow Jones stock market index hitting its peak in October with the real estate market flourishing as homes hit peak prices as well. However, there were clear macroeconomic red flags across the board that a recession was coming, ranging from banks refusing to conduct business with each other and showing internal struggles to a growing bubble in the housing market and the infamous subprime mortgage and predatory lending practices. By September of 2008, the economy began to collapse as the stock market fell rapidly, the housing market bubble burst, and financial institutions either closed or needed bailouts. The macroeconomic impact was enormous, affecting the global economy and trade and influencing industries and people with no connections to the major causes of the crisis. It was the worst economic recession since the historic Great Depression of 1929 and has had profound impacts on the American economy, financial industry, regulation and policy, and models of risk assessment and forecasting. The objective of this paper is to determine the major causes of the 2008-2009 financial crisis (Great Recession) and determine the consequences of the recession and how it has changed the listed macroeconomic aspects in the context of the general U.S. economy.

Literature Review

The foundations to the Great Recession began in the early 2000’s when the market experienced a brief recession due to burst of the dot-com bubble, terrorist attacks, and some scandals in the finance sector. People and policymakers were scared of a greater recession arriving. In order to stave off recession, the Federal Reserve began an expansionary monetary policy and reduced interest rates a total of 11 times by almost 5% in a matter of a year, reaching as low as 1.75% in December of 2001 (Amadeo, 2020). This resulted in liquidity flooding the economy, resulting in bankers, businesses, and private individual to jump on the opportunity to borrow large sums of money, but often without the assets or ability to repay it.

Housing Market and Subprime Mortgages

One of the primary causes of the financial crisis is attributed to the housing market which was directly tied in with subprime loans and mortgages described earlier. Subprime loans are defined as a category of credit given at a high interest rates and fees given to less than ideal borrowers that do not have the necessary credit history or financial stability to manage the credit burden (Coghlan, McCorkell, & Hinkley, 2018). In the early 2000’s, the U.S. government adopted the policy approach of providing homes to more Americans. In the context of low federal interest rates, borrowers flooded to capitalize on the opportunity of purchasing a home, the epitome of the American suburban dream. Banks were more than willing initially to provide these loans since the federal rate was so low and they could charge higher interest rates for consumers. The demand for home loans and buyers, resulted in a rapid rise of property values.

Encouraged by this illusionary economic boom and low inflation rates, the federal interest rate was lowered to 1% by mid-2003. This economic environment of easy credit and high-yield subprime mortgages became a highly profitable enterprise. Consumers were encouraged to fulfill their immediate desires using credit with huge discounts and low down- payment but few considered long-term financial planning or consequences. In economics, it is the axiom of institutions to maximize profit. For banks investing in housing was profitable as they enticed consumers with low down-payments (~10%) and thirty-year loan rates of 3%, but subprime mortgage contracts allowed for banks to adjust interest rates after three years (Sorkin, 2009). When the consumer could no longer pay the mortgage, the bank would take ownership of the home, gain profit from interest percentages and essentially repeat the process.

This ties into the next cause of predatory lending practices and irresponsible risk management by financial institutions. The banking system developed a new system of repackaging the subprime mortgage loans into collateralized debt obligations (CDOs) and sold to to other financial organizations. The subprime mortgages were collected into CDOs and sold as a derivative to raise more funds for even more loans, with the collateral being the very fact that these mortgages and loans would be repaid by households. At the same time, deregulation by the government relaxed net capital requirements for major investment firms, allowing them to leverage more than 30 times the initial investment (Michello & Deme, 2012). In a sense it was a looping pyramid scheme which resulted in continuous profits and rising prices.

Long-Term Causes

In addition to the short-term causes described above, economists attribute certain long-term causes to the crisis as well, many dealing with government macroeconomic policies. As mentioned earlier, the Federal Reserve did not maintain proper long-term planning in lowering the interest rates in combination with strong deregulation of the financial sector leading up to 2008. There was an evident excess supply of liquidity in capital markets globally which can be attributed to the failure of central banks of advanced economies failing to restrain such liquidity and speculative increases in prices. Furthermore, there was an inherent global trade imbalance, with the United States having trade and public sector deficits. When the Federal Reserve lowered the interest rates too low for a prolonged period of time, it compounded the issue of excess liquidity induced by global imbalances. Some economists also note that growing inequality and wage stagnation became a long-term cause of the crisis, with the bottom 90% of the population having only a 10% inflation-adjusted increase in wages between 1976 and 2006. This results in lower aggregate demand and decreased consumption, that was capitalized on by predatory lenders prior to the crisis by promoting and engaging in high-risk capital investments (Wisman, 2013).

By 2005-2006, home prices began to fall as home ownership reached a peak of 70%. The Federal interest rate also began to rise to approximately 5.25%. Since many subprime mortgages interest rates were dependent on the federal one, the higher interest rates began affecting their ability to pay, beginning a cascade of defaults on subprime loans. In turn, subprime lender organizations also began to default, beginning with the well-known New Century Financial. Information began to emerge that large banks and investment firms owned trillions in securities backed by the failing subprime mortgage CDOs (Sorkin, 2009). Financial institutions began to seize funds from hedge funds to stay afloat and the interbank market completely froze internationally, with many facing significant liquidity problems that required intervention by government central banks around the world. Federal funds and discount rates were reduced to approximately 1% and various bailout packages were released such as the National Economic Stabilization Act of 2008 to purchase mortgage-backed securities (Mehdian, Rezvanian, & Stoica, 2019).

At the time, no one realized the full extent of the subprime mortgage crisis and its damages. The insatiable demand for mortgage-backed securities leading up to the crisis resulted in an irresponsible approach to risk management. Banks divided up mortgages and sold them in tranches, making derivates difficult to price. Meanwhile, not just financial institutions were invested in mortgage-backed securities but also corporate assets, mutual funds, and pension funds. Even the pension funds that typically approach investment safely invested into subprime mortgages, believing they were insured by what was sold as credit default swaps by the American Insurance Group (AIG) which would technically cover costs if the mortgage was defaulted upon. However, when the system began to collapse, AIG could not cover cash to cover all the swaps it had sold. Despite the belief of the Federal Reserve at the time, the crisis was not confined to the housing sector alone, affecting banking and industry who stopped lending to each other fearing worthless collateral in the form of subprime mortgages (Sorkin, 2009).

Bailouts by the federal government began by mid-2008 as the situation deteriorated in the housing and financial market. JP Morgan Chase and AIG were offered multibillion-dollar packages, while Congress authorized the purchases of mortgage companies Fannie Mae and Freddie Mac which are still largely owned by the government (Coghlan et al., 2018). Stock markets began to collapse rapidly and series of bailout and restructuring deals had to be made with the government.

Consequences

The consequences of the 2008 financial crisis were both short-term and far-reaching, with impacts felt to this day. It is first important to consider the human and social cost of the crisis, resulting in mistrust in the financial system, massive losses of employment and residency, and even lives lost due to increased levels of crimes and suicides related to the crisis. Short-term consequences resulted in hundreds of billions of dollars of government bailouts and strongly reduced public spending across all levels of government, with measures mostly helping corporations rather than individual households. U.S. households lost on average of $5,800 in income during the acute stages of the recession, with an estimated $648 billion income lost due to slow economic growth post crisis. At least 5.5 million jobs in the U.S. were lost during the crisis.

Home values dropped with a $3.4 trillion decline in real estate wealth between 2008-2009. The stock market value also dropped by $7.4 trillion in the same period (Pew Charitable Trusts, 2010). The macroeconomic and financial costs Long-term consequences include instability of the global financial system that has led to deep austerity and political instability across the world. However, there are some positive changes, such as structural changes and shifting dynamics in the macroeconomic field, discussed in the next section (Arora & Rathinam, 2011). There is increased regulation, even with some rollbacks of the current U.S. administration, the government and international bodies are greater aware of red flags and necessary decision-making to prevent repetition of such a devastating economic crisis.

The 2008 financial crisis is unique among economic recessions which occur periodically, not only in its scale, but its inherent complexity. Although most recessions are driven by macroeconomic factors, there is often an evident identifiable cause which is often self-correcting. The subprime mortgage concept is often seen as the major cause of this particular crisis, but it is simply a reflection of the greater disarrangement in the financial system at the time and highlights the other significant underlying cause of the crisis which is government deregulation leading up to it. However, now that more than a decade passed since the crisis and its repercussions, it is evident how the 2008 recession ultimately changed U.S. macroeconomics.

Leading up to 2008, the world ranging from policymakers to bankers to educators saw U.S. macroeconomics as a straightforward, predictable, and benign concept. As a highly developed economy, the United States was seen a country which saw stable economic fluctuations that were essentially self-correcting, based on the rational expectations macroeconomic approach of the 1970’s. Over decades, little changed other than models of assessing and predicting the future, once again expecting regularity in economic fluctuations, and thus being able to analyze previous events and decisions to predict the future. Macroeconomic models were linear, and a small shock such as a decrease in house prices could not have big impact, making it impossible to predict or solve. At the same time, since the 1980’s, advanced economies existed in a manner of ‘great moderation’ where there was a decrease of variability of output and its elements such as consumption and investment. Monetary policy was safe with low and less variable inflation, and mostly small shocks in the economy. These strict economic policies were thought to be a failsafe against small shocks devastating the economy. Even such events as bank runs that are taught in history and economic courses as the worst event in a recession were now largely preventable due to federal insurance and central bank protection policies (Blanchard, 2014).

However, the 2008 recession largely blindsided everyone as it is the matter of small shocks ranging from the housing bubble to liquidity issues in banks and corporations that led to the collapse and malfunctioning of the economy. Financial institutions and regulators underestimated risks as financial structures were exposed to shocks due to their liquidity structure, often without realizing it. When the U.S. housing market burst, it led to concerns on which claims were held by which financial institution and which were essentially solvent in the context of the subprime mortgage crisis. It led to ‘liquidity runs’ not on banks but mostly on financial organizations which were operating like banks without the proper protections or regulations (Blanchard, 2014). Prior to 2008, economic stimulus in advanced economies would be used as part of accommodative monetary policy which would support aggregate demand. Central banks would increase money supply to reduce interest rates that allowed businesses to borrow and expand at lower costs, potentially positively impacting employment rates and thus, consumer spending in the country. As interest rate was reduced to boost economic activity, the zero lower bound level was quickly reached and posed a risk of deflation that increases the real value of public and private debt. There was little availability for monetary maneuvers in this scenario (Dequech, 2018).

Expansionary fiscal policy is another method of strengthening aggregate demand. Fiscal policy was used to increase public spending to supplement private demand as well as reduce taxes. However, this led rising government debt levels and perceived sovereign risk, which was inconceivable before the crisis (Blanchard, 2014). Furthermore, this macroeconomic approach is commonly mistrusted by the public and investors due to the theoretical crowding out effect which states that government spending discourages private investment. The government policy also indirectly impacts borrowing costs due to an increased demand for loans, raising interest rates. Without stimulation to invest by firms, neither the production sector nor the labor market would grow. Fiscal stimulus police may have a short positive effect but would effectively stagnate the economy in the long-term. Nevertheless, the 2008 crisis required fiscal stimulus as economists believed the zero-bound levels of interest rates would prevent a decrease of private investment given the circumstances (Dequech, 2018).

The perfect storm of problems and events which cascaded into the 2008 crisis brought to light important but largely forgotten macroeconomic theories, the primary of which is the Hicks-Hansen investment savings (IS) – liquidity preference-money supply (LM) model, otherwise known as the IS-LM model. The timeline and consequences of the recession described in the literature review describe an economy which responded to negative shocks through lowered demand for goods across all industries. The Keynesian IS-LM model developed in the 1980’s places demand at the center of business cycle fluctuations along with the ‘paradox of thrift,’ stating that during recessions households tend to reduce spending and save more, while the complete opposite is necessary to kickstart economic growth, but in turn leads to businesses decrease production based on demand and the recession deepens. This was clearly evident during the Great Recession during which savings in American households increased from 2.9% to 5% (Christiano, 2017). A modern version of the IS-LM model has become central to macroeconomic policy and planning as it shifted dynamics from the view that markets are self-managing and inflation is a failure of policy to the fact that the economic system can become dysfunctional independently and government intervention is necessary to manage the broader national economy (Krugman, 2018).

The 2008 financial recession had these evident macroeconomic impacts as well as influences on monetary policy. The crisis resulted in large accumulations of debt for individuals, organizations, and the government which all of the involved parties are still attempting to deal with. The crisis resulted in the financial system, which was the problematic epicenter of this recession, being more regulated and less opaque, largely due to the efforts of the Dodd-Frank Act of 2010. Long-term macroeconomic policies must consider margins for maneuver in cases of crisis, allowing for management of inflation rates, nominal interest, and investment. Economists are now aware of the numerous non-linearities of the modern economy both macroeconomic policy and financial regulation are set to maintain the economy away from these non-linear, unpredictable causations and systemic risk.

Summary and Conclusion

The 2008 financial crisis was the largest recession in modern world economic history. Its impact and complexity were driven by profit-driven finance instruments and lack of regulatory measures in place for certain sectors of the economy as well as numerous other short- and long-term macroeconomic factors. This recession was unique in that it defied any prediction, means of protection and self-correcting for the economy, and existing economic models at the time. The consequences for macroeconomics were enormous across the world, resulting in economic stagnation, unemployment, loss of income, and massive bailouts to prevent the system from completely collapsing. However, analyzing macroeconomic elements and theories, it has allowed for major changes to the manner that the economy is studied, regulated, and driven. While recessions will continue to be a periodic occurrence based on economic cycles, it is the avoidance of critical errors and red flags in long-term economic planning that is key to preventing such devastating crises again.

Amadeo, K. (2020). 2008 financial crisis. The Balance . Web.

Arora, D., & Rathinam, F. (2011). The Macroeconomic Impact of Financial Crisis 2008-09 . Web.

Blanchard, O. (2014). How the crisis changed macroeconomics . World Economic Forum . Web.

Christiano, L. J. (2017). The Great Recession: A macroeconomic earthquake . Web.

Coghlan, E., McCorkell, L., & Hinkley, S. (2018). What really caused the Great Recession? . Web.

Dequech, D. (2018). Institutions in the economy and some institutions of mainstream economics: From the late 1970s to the 2008 financial and economic crisis. Journal of Post Keynesian Economics, 41 (3), 478-506. Web.

Krugman, P. (2018). Good enough for government work? Macroeconomics since the crisis. Oxford Review of Economic Policy, 34 (1-2), 156-168. Web.

Mehdian, S., Rezvanian, R., & Stoica, O. (2019). The effect of the 2008 global financial crisis on the efficiency of large U.S. commercial banks. Review of Economic and Business Studies, 12 (2), 11-27. Web.

Michello, F. A., & Deme, M. (2012). Communication failures, synthetic CDOs, and the 2008 financial crisis . Academy of Accounting and Financial Studies Journal, 16 (4), 105-122. Web.

Pew Charitable Trusts. (2010). The impact of the September 2008 economic collapse . Web.

Sorkin, A. R. (2009). Too big to fail: The inside story of how Wall Street and Washington fought to save the financial system—and themselves . New York, NY: Viking Press.

Wisman, J. D. (2013). Wage stagnation, rising inequality and the financial crisis of 2008. Cambridge Journal of Economics, 37 (4), 921-945. Web.

Cite this paper

Select style

- Chicago (A-D)

- Chicago (N-B)

BusinessEssay. (2023, August 7). The Great Recession of 2008 in the United States. https://business-essay.com/the-great-recession-of-2008-in-the-united-states/

"The Great Recession of 2008 in the United States." BusinessEssay , 7 Aug. 2023, business-essay.com/the-great-recession-of-2008-in-the-united-states/.

BusinessEssay . (2023) 'The Great Recession of 2008 in the United States'. 7 August.

BusinessEssay . 2023. "The Great Recession of 2008 in the United States." August 7, 2023. https://business-essay.com/the-great-recession-of-2008-in-the-united-states/.

1. BusinessEssay . "The Great Recession of 2008 in the United States." August 7, 2023. https://business-essay.com/the-great-recession-of-2008-in-the-united-states/.

Bibliography

BusinessEssay . "The Great Recession of 2008 in the United States." August 7, 2023. https://business-essay.com/the-great-recession-of-2008-in-the-united-states/.

- Sustainable Growth and Security in the Gulf Cooperation Council: Recommendations for UAE

- Legal and Illegal Immigration for the U.S. Economy

- Natural Resources and Economic Development Nexus

- Economic Drivers in Harford’s “The Undercover Economist”

- Economics for Business

- The Efficient Market Hypothesis’ Concept

- Interest Rate, Risk-Return and Time Value of Money

- Tourism in Dubai: Economic Factors of Demand

- Economics for Managers

- Perfect Competition’ Characteristics

- Latin America Economic Growth

- Gross Domestic Product in Gulf Cooperation Council

- The Political Economy of Dubai

- Economics of Swaziland

- Market Liberalization for Developing Countries

- US Economic Recession of 2008 Words: 597

- Financial Crisis: Beyond 1929 – 2008 Comparison Words: 3022

- Financial Management During the Recession Words: 2646

- US Economic Recession Impact Words: 1664

- Types and Causes of Financial Crisis Words: 854

- Unemployment and Economic Stagnation During the 2008 Great Recession: Causes and Effects Words: 1100

- Financial Institution in the Financial Crisis of 2008 Words: 1381

- Current Economic Recession for USA Words: 1443

- Impact of the 2007-2009 Global Financial Recession Words: 2046

- The Financial Crisis of 2008: Problem and Causes Words: 1016

- Demand-Side Policies and the Great Recession of 2008 Words: 839

- Global Financial Crisis of 2008-2009 Assignment Words: 580

- The Financial Crisis: The USA in 2007 Words: 2809

- Financial Crisis of 2008 in the U.S. – Meltdown Words: 1460

- Analysis of the Great Recession Words: 871

- The 2007-2008 Economic Crisis Words: 3001

- Causes of the Mortgage Crisis in the USA and UK Words: 4189

- Financial Crisis and Great Recession: Why Keynesian Model Failed Words: 1403

- Fiscal and Monetary Policies in the 2008 Recession Words: 909

- Researching of Economic Recession Words: 870

- “The Causes and Current State of the Financial Crisis” by Zindi Words: 639

The Great Recession of 2008: Causes and Consequences

Introduction, literature review.

In 2008, the world began the financial and economic crisis, which manifested in the form of a substantial decline in the leading economic indicators in most countries with developed economies, which subsequently escalated into a global economic recession. The emergence of the crisis is associated with several factors: the general cyclical nature of economic development, overheating of the credit market and the resulting mortgage crisis, high commodity prices, including oil, and stock market overheating. The forerunner of the 2008 financial crisis was the US subprime crisis, which affected high-risk mortgages in early 2007. The second wave of the mortgage crisis occurred in 2008, spreading to the standard segment, where state mortgage corporations refinance bank loans. A 20% drop in property prices left US homeowners nearly five trillion dollars poorer (Berberoglu, 2014). Moreover, the quotes of stock exchanges fell significantly, which affected the stock market. This is how the 2008 global financial crisis unfolded. Economists are still arguing about why it started and ended today, but most of the phenomena have been studied in sufficient detail. However, the main argument of this paper is that the collapse of the banking system caused the recession, while the consequences affected the worldwide economics.

At the heart of the global financial crisis that erupted in 2008 in the United States and spread all over the world at lightning speed is the collapse of the banking system. The starting point, which served as the beginning of turbulent changes, was the so-called “cheap loans”. It is known that the change in the refinancing rate in the United States is the main instrument of the state’s monetary policy. In 2003, the Fed decided to lower the refinancing rate to 1% in order to stimulate the credit expansion of banks and thus ensure a quick exit from the crisis caused by the economic recession of 1995-2001 (Berberoglu, 2014). As a result of these measures, during 2004-2006, economic growth was observed in the United States: GDP increased from 11,797 trillion USD up to 13314 trillion dollars, which amounted to 3% of the annual GDP growth (Berberoglu, 2014). The economic boom was accompanied by full employment of the population, a high investment policy, and the rapid development of high technology industry.

The lower refinancing rate enabled commercial banks to expand their credit by lending at low-interest rates. Cheap loans led to an increase in demand in the mortgage market and, as a result, to an increase in real estate prices. From 2004 to 2006, real estate prices increased by an average of 10% per year, which led to a doubling of house prices by 2007 (Berberoglu, 2014). Insufficient banking system regulation allowed financial agents to create new profit maximization tools by carrying out somewhat risky operations. One such instrument was the subprime mortgage. Subprime loans have a reduced down payment or none at all, are issued without guarantees and guarantees and do not require the borrower to provide documentary evidence of his income and property (Islam & Verick, 2011). In fact, any US citizen can get a subprime loan, regardless of their income, financial condition, and reputation.

The peculiarity of subprime loans is that they are a type of mortgage loan with a floating interest rate. By resorting to this type of lending, banks did not see the great danger lurking in providing this type of loan since, in the event of a default, the borrower could always sell the property at a higher market price and close the loan. Mortgages have thus become a public financial vehicle, a phenomenon that has created new perspectives and controversies property (Islam & Verick, 2011). In order to increase their creditworthiness, banks are beginning to look for new ways to attract financial resources to expand their credit expansion. Securitization is becoming such a new tool.

If previously issued loans were the active part of the bank balance, they are now being used as liabilities, further increasing the money supply. Banks “sell” issued mortgage loans to financial institutions specializing in securitization, thereby replenishing their lending capacity and hedging counterparty risk. Investment banks and other financial institutions buy secured mortgage loans or mortgage bonds, which pool them all and sort or tranche them, depending on risk diversification, into less risky, medium risk, and risky. This type of security is called a collateralized debt obligation.

The reduction of the refinancing rate to 1% meant not only cheap loans but also deposits with a low-interest rate. In search of more good placements of their financial resources, investors begin to buy SDOs, believing that investing in real estate-backed securities is less risky than other securities, such as shares. Demand for bonds backed by debt obligations stimulates an increase in supply from investment banks, which, in turn, creates conditions for issuing more mortgage loans. Thus, the American economy becomes a debt-based credit expansion and a lightning-fast non-cash money supply. This financial model does not lead to sustainable economic development but, on the contrary, is fraught with a real threat of default, which happened in 2008.

Since 2006, real estate prices have been falling. According to Standard & Poor’s, the fall was 20% of the market value of 2006. In addition, after making sure that the US economy is already out of recession and on the path of economic growth, the Fed is changing financial policy in favor of limiting the credit expansion of banks, raising the rate refinancing from 1 to 5.25%, which leads to an increase in the interest rate on loans (Stiglitz, 2010). The change in the economic situation also led to an increase in the interest rate on already issued sub-standardized loans.

All these changes led to borrowers with low solvency being unable to meet their credit obligations. The low market value of the house also prevented them from closing the loan by selling the property. This economic situation led to an increase in the number of defaults and, as a result, to the transfer of real estate into the bank’s ownership. Some solvent borrowers, according to an analysis of the current problem in the real estate market, stopped paying interest on the loan, not seeing the point in paying an amount that vastly exceeds the actual market value of the house. The default of borrowers led to the collapse of not only the mortgage market but also the market for mortgage-backed securities and, as a result, to a drop in investment and the bankruptcy of many financial companies (Stiglitz, 2010). Thus, by 2008, a difficult situation had developed in the United States, a kind of “debt hole,” which led to the most devastating crisis since the Great Depression.

The global financial crisis severely impacted the functioning of the entire world economy. World GDP by 2009 decreased by 5.8% from the level of 2007 (Arpino & Obydenkova, 2020). According to the ILO, the world unemployment rate increased by 0.8% compared to 2008, amounting to 6.6% (Arpino & Obydenkova, 2020). By 2008, the unemployed amounted to about 15 million. Public debt increased sharply due to borrowing to cover the budget deficit associated with the collapse of national currencies, as well as a sharp reduction in income (Arpino & Obydenkova, 2020). The direct consequences of the crisis also include – a decrease in trade volume, volatility in commodity prices, a fall in the value of financial assets, a global fall in real estate prices, an outflow of capital, low liquidity, a current account deficit in the balance of payments, an increase in the cost of loans, a sharp decrease in direct investment, a decrease in profitability from the tourism industry, declining remittance receipts, sharp declines in export earnings, and payments imbalances. According to OPEC estimates, global demand for crude oil fell by 1.3 million barrels per day, which reduced production.

According to the UN, a distinctive feature of this crisis is that, due to the high degree of globalization and integration of national economies, the crisis has equally affected both developed and developing countries. However, the poorest countries, whose economies depend on external financing and international trade, were most vulnerable to the economic downturn. In Europe and North America, growth rates decreased from 3.2% to 0.9% in 2008 to -3.7% in 2009. Only by 2010 did economically developed countries manage to overcome the crisis in the economy and enter the path of economic growth with GDP growth of up to 2.6% (Arpino & Obydenkova, 2020). In most developed countries, unemployment remains reasonably high, averaging around 10%. The highest rate falls in Spain, where the share of unemployed in 2009 was 14%. The lowest unemployment rate is seen in the Netherlands, where it amounted to 2.9% in 2009.

In 2008, ORS accounted for almost 1.5 trillion. US dollars, or more than 76% of the world’s foreign direct investment. In 2009, their total volume almost halved to $780 billion. In 2008, foreign direct investment was sent to the EEC countries in the amount of almost 1.1 trillion USD; this accounted for more than 61% of the world’s inflow of foreign direct investment (Arpino & Obydenkova, 2020). The crisis also had a negative impact on the development of trade. In the US, exports fell by 15% and imports by 17%; in the EU, both exports and imports fell by 15% (Arpino & Obydenkova, 2020). In some countries, such as Ireland, Spain, Greece, Portugal, and Italy, there was an increase in the state budget deficit, which led to a new round of economic recession, but already in the EU.

According to ECOSOC, from 2008 to 2009, in Latin America and the Caribbean, there was a decline in GDP by 1.9% or 3% per capita. The decline in economic growth was reflected in the structure of employment of the population, an increase in unemployment to 8.3% (Arpino & Obydenkova, 2020). Due to the decline in prices for raw materials and goods of material production and the increase in exchange rates in Latin America, there is a sharp drop in aggregate demand and, as a result, a decrease in inflation from 8.3% in 2008 to 4.3% by 2009 (Blanco, 2010). Foreign direct investment decreased by 39.1% (Blanco, 2010). The experts also noted a decrease in business and consumer expectations, which further worsened the investment climate and influenced changes in the demand structure.

Involvement in foreign trade makes Asian countries dependent on the economic situation in the world. A sharp drop in demand in the American market affected the reduction in production in Asian countries and, as a result, negatively impacted the region’s development. There is a sharp drop in prices for agricultural products, in particular, cereals, by up to 50%, thereby undermining the economy of several Asian countries, the main branch of specialization of which remains agriculture (Wan, 2010). The economic downturn caused GDP growth in the region to fall from 6.8% to 4.1% (Wan, 2010). The decline in economic activity led to a sharp jump in unemployment and, consequently, to socio-political unrest in the region. Demonstrations swept through some Asian countries in a wave, further exacerbating the economic situation in the region and undermining state authority.

Regarding the consequences, it should be said that the crisis affected a considerable number of countries, especially countries with developed economies. In general, the consequences of the crisis include an actual drop in global economic indicators: a decrease in global GDP, a decrease in world trade, a decrease in production, recessions in many countries of the world, a decrease in economic activity, and a fall in real estate prices. Of the countries of the Eurozone, Greece suffered the most significant losses due to its violation of fiscal policy and the EU member states that were divided and unprepared for solidarity actions.

Measures to overcome the crisis in individual countries differed, but most countries relied on monetary policy to overcome the 104 crisis. As alternative measures to overcome the crisis, the proposal of Paul Krugman was considered, who argued that during a crisis, one should not be afraid of spending; on the contrary, one should spend, not save. However, this view is highly controversial and has been criticized by many leading economists. The global trend after the acute phase of the crisis in 2008 was the weakening of the middle class in the world, while before the crisis, its share in the total volume of world wealth remained stable for a long time.

The main advantages of the crisis, which can positively affect almost all companies, are the following: the possibility of attracting more professional staff on favorable terms; reduction in the cost of certain types of services used by the company; using an ostrich development strategy. The latter assumed global optimization and cleaning because, on the one hand, everyone panics and reduces their marketing activity and works on developing the management system. However, on the other hand, the costs of these activities are becoming less. Therefore, these tasks can be solved at a lower cost during a crisis and improve their competitive position since most companies will not do this.

Thus, the crisis of 2008-2009, which broke out in the United States due to the collapse of the banking system, echoed around the world, leading to a sharp decline in global GDP, an increase in unemployment, a reduction in foreign direct investment, a fall in global currency and stock markets, and an increase in social – economic tension in the world. This crisis showed the vulnerability of national economies and their dependence on the world situation in the context of integration and globalization, thus proving the low effectiveness of the current regulation of financial flows.

Arpino, B., & Obydenkova, A. V. (2020). Democracy and political trust before and after the great recession 2008: The European Union and the United Nations. Social Indicators Research, 148 (2), 395-415. Web.

Berberoglu, B. (Ed.). (2014). The global capitalist crisis and its aftermath: The causes and consequences of The Great Recession of 2008-2009 . Ashgate Publishing, Ltd.

Blanco, L. (2010). Latin America and the financial crisis of 2008: lessons and challenges. Pepperdine Policy Review, 3 (1), 8. Web.

Islam, I., & Verick, S. (2011). The great recession of 2008–09: Causes, consequences and policy responses. In From the great recession to labor market recovery (pp. 19-52). Palgrave Macmillan, London. Web.

Stiglitz, J. E. (2010). Interpreting the Causes of the Great Recession of 2008. Financial System and Macroeconomic Resilience: Revisited, 53 (1), 297. Web.

Wan, M. (2010). The great recession and China’s policy toward Asian regionalism . Asian Survey, 50 (3), 520-538. Web.

Cite this paper

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2023, November 25). The Great Recession of 2008: Causes and Consequences. https://studycorgi.com/the-great-recession-of-2008-causes-and-consequences/

"The Great Recession of 2008: Causes and Consequences." StudyCorgi , 25 Nov. 2023, studycorgi.com/the-great-recession-of-2008-causes-and-consequences/.

StudyCorgi . (2023) 'The Great Recession of 2008: Causes and Consequences'. 25 November.

1. StudyCorgi . "The Great Recession of 2008: Causes and Consequences." November 25, 2023. https://studycorgi.com/the-great-recession-of-2008-causes-and-consequences/.

Bibliography

StudyCorgi . "The Great Recession of 2008: Causes and Consequences." November 25, 2023. https://studycorgi.com/the-great-recession-of-2008-causes-and-consequences/.

StudyCorgi . 2023. "The Great Recession of 2008: Causes and Consequences." November 25, 2023. https://studycorgi.com/the-great-recession-of-2008-causes-and-consequences/.

This paper, “The Great Recession of 2008: Causes and Consequences”, was written and voluntary submitted to our free essay database by a straight-A student. Please ensure you properly reference the paper if you're using it to write your assignment.

Before publication, the StudyCorgi editorial team proofread and checked the paper to make sure it meets the highest standards in terms of grammar, punctuation, style, fact accuracy, copyright issues, and inclusive language. Last updated: November 25, 2023 .

If you are the author of this paper and no longer wish to have it published on StudyCorgi, request the removal . Please use the “ Donate your paper ” form to submit an essay.

The Great Recession of 2008

29 Sep 2022

Format: APA

Academic level: Master’s

Paper type: Research Paper

Downloads: 0

The Great Recession was a period marked by severe economic slowdown and decline across different markets in the world. The Great Recession started in 2087 and ended in 2009 although its timing and scale varied from one state to another. It originated from the collapse of the real estate industry in the United States as a result of the global financial crisis which occurred between 2007 and 2008. The mortgage crisis in the United States which also occurred between 2007 and 2009 also contributed to the Great Recession of 2008. The Great Recession of 2008 had a significant impact on several industries as it leads to a decline in the demand for goods and services. One major sector that experienced a significant impact due to the global financial crisis is the financial markets (Walker et al., 2016). The financial and banking industry incurred severe impacts of the global financial crisis since they offered loans to many of the firms which later found difficulty to repay the debts. Consequently, many of the lending institutions increased the rate of interest and thus make it possible for individuals and businesses to obtain loans to fund their operations. Due to the negative impact of the Great Recession of 2008 on the financial sector, it is important for the entrepreneurs to develop appropriate strategies that can help them minimize its impacts on their organizations. In addition, an entrepreneur is required to assess the changes that the Great Recession caused in the business environment in order to make appropriate responses and adjustments.

The Economic Information that needs to be gathered

The assessment of the impact of the Great Recession requires an entrepreneur to gather adequate facts and economic information to determine its magnitude and the possible outcomes. In 2008, the Great Recession was characterized by the changes in various economic variables. One of the notable variables of the 2008 economic recession was the changes in the gross domestic product (Rognlie et al., 2018). The United States experienced a decline in the gross domestic product during the global financial crisis. The decline in the gross domestic products led to the decline in the purchasing power of consumers (Kriesi & Pappas, 2015) . The table below shows the changes in the gross domestic products during the Great Recession.

Delegate your assignment to our experts and they will do the rest.

From the table, it can be noted the GDP of the United States experienced a decline between 2007 and 2009 and then started to rise in 2010. It shows that during the global financial crisis, the United States experienced a decline in its production output. The graph below shows the trend in GDP changes from 2007 to 2011.

From the graph, it can be noted that the lowest level of GDP was recorded in 2009 which also marked the end of the crisis. After 2009, the economy of the United States started to increase as demonstrated by the growth in the gross domestic products.

Entrepreneurs should know the trend in GDP since it affects other important economic variables such as unemployment rates and the consumers spending. The unemployment rate in an economy can determine the purchasing power of consumers (Kalleberg & Von Wachter, 2017). Countries with a high rate of unemployment can experience a decline in consumers spending. Since many entrepreneurs are often engaged in the production of goods and services to satisfy the needs of the consumers, they will be interested in knowing their purchasing power to determine the amount of the goods and services to produce. When a country experienced a low unemployment rate, the level of consumer spending will be reduced and this eventually leads to a reduction in demand for goods and services. During the Great Recession, the entrepreneurs should avoid excess production given the reduction in the demand for goods and services.

The table above shows that there was a reduction in the gross private investment from the onset of the Great Recession in 2007. The decline in the private investment can indicate that there is a lack of adequate capital for investment, high-interest rates and the unwillingness of the entrepreneurs to invest due to uncertainties and risks in the business environment.

A good entrepreneur should make an informed decision using relevant data and information to ensure the survival of the business in a competitive business environment. Many of the companies who invested a huge amount of dollars during the financial crisis collapsed. This can be explained by the graph below which indicates a decline in the gross private investment a condition that leads to the collapse of many companies.

After examining the changes in the business environment as a result of the Great Recession, an entrepreneur should come up with appropriate organization structure and strategies to minimize such changes. In essence, it is important for the entrepreneur to apply strategic management to ensure the success of the company. In responding to the changes caused by the Great Recession, it is important that an entrepreneur cut down some of its operation cost by reducing its spending (Kroft et al. 2016). In addition, short-term measures such as reducing the number of employees can help reduce the expense of the company and ensure that it survives in the business environment. Besides, the entrepreneur should avoid taking a huge amount of loans to funds its operation since, during the Great Recession, the interest charged on loans are high. In addition, the financial markets are surrounded by uncertainties that can expose businesses to huge risks.

References

Walker, S. M., Earnhardt, M. P., Newcomer, J. M., Marion Jr, J. W., & Tomlinson, J. C. (2016). Crisis Leadership During the Great Recession of 2008. International Journal of Leadership and Change , 4(1), 9.

Rognlie, M., Shleifer, A., & Simsek, A. (2018). Investment hangover and the great recession. American Economic Journal: Macroeconomics, 10(2), 113-53.

Kalleberg, A. L., & Von Wachter, T. M. (2017). The US Labor Market During and After the Great Recession : Continuities and Transformations. RSF.

Kroft, K., Lange, F., Notowidigdo, M. J., & Katz, L. F. (2016). Long-term unemployment and the Great Recession: the role of composition, duration dependence, and nonparticipation. Journal of Labor Economics , 34(S1), S7-S54.

Kriesi, H., & Pappas, T. S. (Eds.). (2015). European populism in the shadow of the great recession (pp. 1-22). Colchester: Ecpr Press.

- The Economical Concept of a Free Market

- Netflix and the Issue of Product Pricing

Select style:

StudyBounty. (2023, September 15). The Great Recession of 2008 . https://studybounty.com/the-great-recession-of-2008-research-paper

Hire an expert to write you a 100% unique paper aligned to your needs.

Related essays

We post free essay examples for college on a regular basis. Stay in the know!

The Impact of European Colonization on Developing Nations' Politics and Economy

Nordstrom inc. investment opportunity proposal.

Words: 2105

How Tariffs Can Impact Demand and Supply

Technology in the global economy, the financial collapse of 2008/2009, capital flow and currency crises, running out of time .

Entrust your assignment to proficient writers and receive TOP-quality paper before the deadline is over.

IMAGES

VIDEO

COMMENTS

The Great Recession began in December 2007 and ended in June 2009, which makes it the longest recession since World War II. ... These programs included the Economic Stimulus Act of 2008 and the American Recovery and Reinvestment Act of 2009. ... Related Essays. Federal Reserve Credit Programs During the Meltdown;

Like the Great Depression of the 1930s and the Great Inflation of the 1970s, the financial crisis of 2008 and the ensuing recession are vital areas of study for economists and policymakers. While it may be many years before the causes and consequences of these events are fully understood, the effort to untangle them is an important opportunity ...

Business essay sample: The paper determines the major causes of the 2008-2009 financial crisis and the consequences of the recession in the context of the general U.S. economy. Call to +1 844 889-9952

Order custom essay The Great Recession of 2008 with free plagiarism report 450+ experts on 30 subjects Starting from 3 hours delivery Get Essay Help. This, coupled with rising oil prices at $100 a barrel, slowed down the growth of the economy. Tax cuts are the first step that a government fighting recessionary trends or a full-fledged recession ...

In From the great recession to labor market recovery (pp. 19-52). Palgrave Macmillan, London. Web. Stiglitz, J. E. (2010). Interpreting the Causes of the Great Recession of 2008. Financial System and Macroeconomic Resilience: Revisited, 53(1), 297. Web. Wan, M. (2010). The great recession and China's policy toward Asian regionalism.

In 2008, the world faced the worst financial crisis since the Great Depression of the 1930's (also known as the Great Recession of 2008-2009). This great Recession was the result of the Subprime Mortgage Meltdown in the United States.

The Great Recession in 2007-2008 was the second largest financial crisis in U.S. history. In this discussion, I will be analyzing how the financial system contributed to the Great Recession and their response to the crisis, the involvement of the U.S. government, missed opportunities to avoid or shorten the crisis, and my personal opinion on the U.S. economy in the next decade.

The Great Recession 2008 essay example for your inspiration. ️ 872 words. Read and download unique samples from our free paper database. ... Home / Economics / Microeconomics / The Great Recession 2008 The Great Recession 2008. Subject: Economics: Type: Informative Essay: Pages: 3: Word count: 872: Topics: Macroeconomics, Microeconomics ...

Essay Sample The Great Recession of 2008 was a global financial crisis that affected millions of people around the world. This article looks at the causes, effects and implications of the recession. ... The Great Recession of 2008 had a significant impact on several industries as it leads to a decline in the demand for goods and services. One ...

The Great Recession of 2008 also cause many other problems. The start of the financial crisis started in 2007 when sub-prime mortgages began to increase. The Federal Reserve flooded the markets with money trying to reduce interest rates, but that failed along with the value of the dollar.